Capital One Secured Card About controls your own credit rated for 5 star by Capital One Secured Card for our United States readers, especially for you at New Orleans, LA, USA. Capital One Secured Card guide you to take control and build your credit with a Capital One Secured credit card.

Capital One Secured Card About. Your Capital One Secured Card guide controls and builds your credit with responsible use. Choose your own monthly due date and payment method - check, online, or at the local branch.

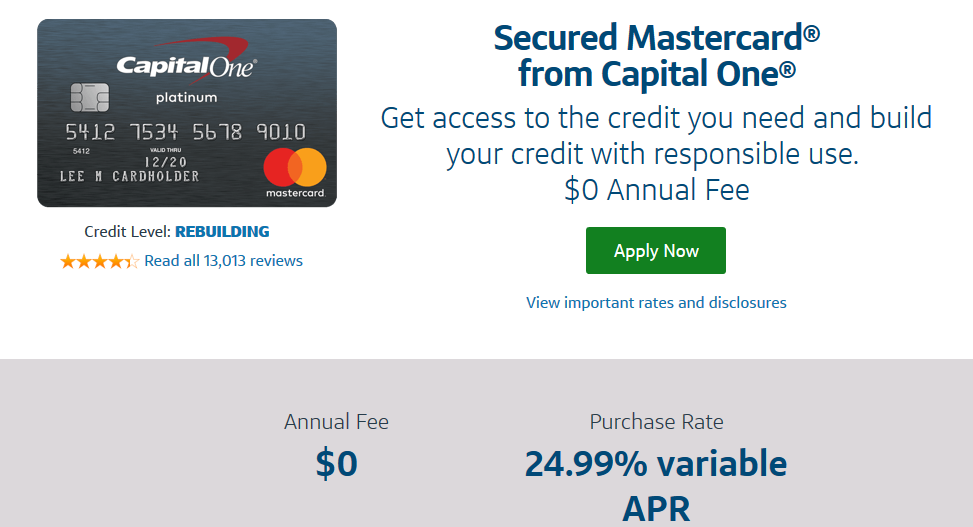

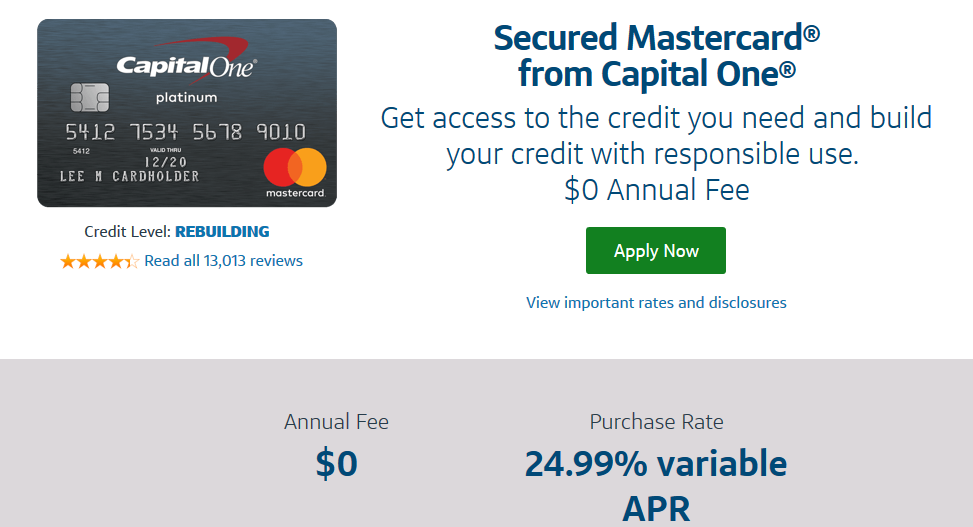

Secured Mastercard® card from Capital One® - Get access to the credit you need and build your credit with responsible use. $0 Annual Fee

Secured Mastercard® card from Capital One® - Get access to the credit you need and build your credit with responsible use. $0 Annual Fee

Capital One Secured Card

Capital One Secured Card;

- Security Deposit Required; A $49, $99 or $200 deposit that can be returned based on your credit worthiness.

- Initial Credit Line; minimum guarantee deposit is required and you will get an initial credit limit of $200. Plus, deposit more money before your account is opened to get a higher credit limit.

- Access a Higher Credit Line; get access to a higher credit limit after making your first 5-month payment on time.

- Personal Payments; choose your own monthly due date and payment method - check, online, or at the local branch.

Getting started is easy.

- Complete and send your application for Secure Mastercard from Capital One.

- After approval of your application, you will be notified of the amount of security deposit required for your account.

- Make your deposit, and accept your card in 2-3 weeks.

What is a secured credit card?

This is a credit card that offers you the opportunity to build or rebuild your credit with responsible use. A secure credit card also requires a refundable deposit, which is saved as collateral for the account. There is no interest applied on the security deposit.How does the Capital One Secure Card work?

Once you are approved, all you need to get started is the minimum guarantee deposit that you need, which you can pay at once or over time. You can make your deposit online or by telephone. When you have made the required minimum guarantee deposit, your account will be opened. The security deposit can be returned if you close your account and pay your balance in full. Your credit card will be regularly reported to the 3 major credit bureaus.What is the difference between a Secure One Credit Credit Card and a prepaid card?

Unlike a prepaid card, a guaranteed card is an actual credit card that reports to the three major credit bureaus - providing opportunities to build your credit, with responsible use. Prepaid cards are more like a debit card and can't help you build your credit because they don't report to the main credit bureau.Does my Secure One Capital Credit Card have the word "safe" on it?

Not. Your Capital One secured credit card will not have the word "secured" on it. This will look like other Capital One credit cards.Can I be refused for Capital One Secured Credit Card?

Yes. Like credit cards, there are certain conditions that can cause your application to be rejected. For example - because a bank account is needed to fund your card, you will be refused if you don't have it.Explore the Capital One credit card

- Notification of Instant Purchases. Receive instant purchase notifications with the Capital One mobile app to track your expenses in real time every time your Capital One credit card is approved.

- Automatic payment. Set up Automatic Payment for your account and your payment will be made automatically every month.

- Account Warning. Prepare personalized emails or text reminders to help you stay on top of your account.

- 24/7 Customer Service. A helpful customer service representative is available to help you 24 hours a day.

- Personal Payments. Choose your own monthly due date and payment method - check, online, or at a local branch - all at no cost.

- Security and Account Warning. You will get an automatic security warning - via text, email or telephone - and can choose to register email or personalized text to stay on top of your account information.

- Virtual Card Number from EnoSM. Pay online purchases with a virtual card number and save your card number yourself.

- SureSwipe / Touch ID. Enter the Capital One Mobile application quickly and safely with your fingerprint or special pattern.

- Card Key. If you misplace a credit card, you can immediately lock your card and turn it back on when you are ready, alright in the Capital One Mobile application.

- Fraud Coverage. You are protected by a $0 Fraud Obligation if your card is lost or stolen.

- Capital One Mobile application. Manage your account anywhere, anytime. Pay your bills, see your balances and transactions - even stay on your credit for free with CreditWise®.

- Eno, your smart assistant from Capital One. Wherever you are, Eno oversees your account 24/7, sends alerts when there is something, and is always ready to answer questions - so you can keep moving.

- CreditWise® from Capital One. Monitor your credit with CreditWise. It's free for everyone - whether you have a Capital One credit card or not - and that won't hurt your score.

- There is no Foreign Transaction Fee. You will not pay transaction fees when making purchases outside the United States.

- Travel Accident Insurance. Get automatic insurance for losses incurred at no additional cost when you use a credit card to buy fees.

- 24-Hour Travel Assistance Service. If your credit card is lost or stolen, you can get an emergency replacement card and advance payment.

- Extended Warranty. You will get additional warranty protection at no charge for items that meet the requirements purchased with your credit card.

- Auto Rental Collision Damage Waiver. Rent a vehicle that qualifies with your credit card and you can be protected from damage due to collisions or theft.

- Transfer your Miles. For more flexibility, transfer your miles to one of our 10+ participating airline partners.

Learn about the Secured Mastercard from Capital One.

Secured "Mastercard" card from Capital One

Capital One Secured Card About controls your own credit.

For more reference about this post, find it on Google, Bing, Yahoo.

Share this post to your friends on social media at: