Capital One Secured Mastercard is a good choice for bad credit rated for 5 star by Capital One Secured Card for our United States readers, especially for you at New Orleans, LA, USA. Capital One Secured Card guide you to take control and build your credit with a Capital One Secured credit card.

Capital One Secured Mastercard is a good choice for bad credit. Build or rebuild credit with a card that is supported by a cash guarantee deposit. This is a good option for those who pay in full every month.

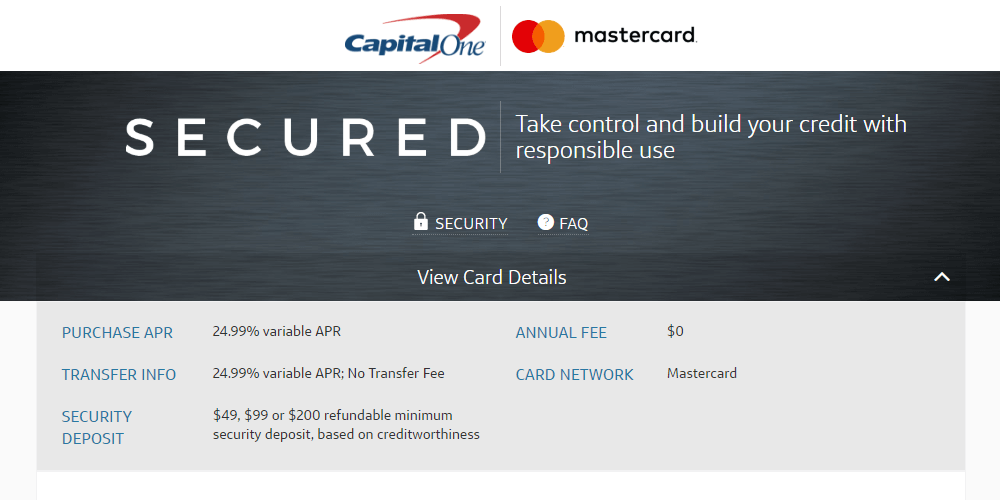

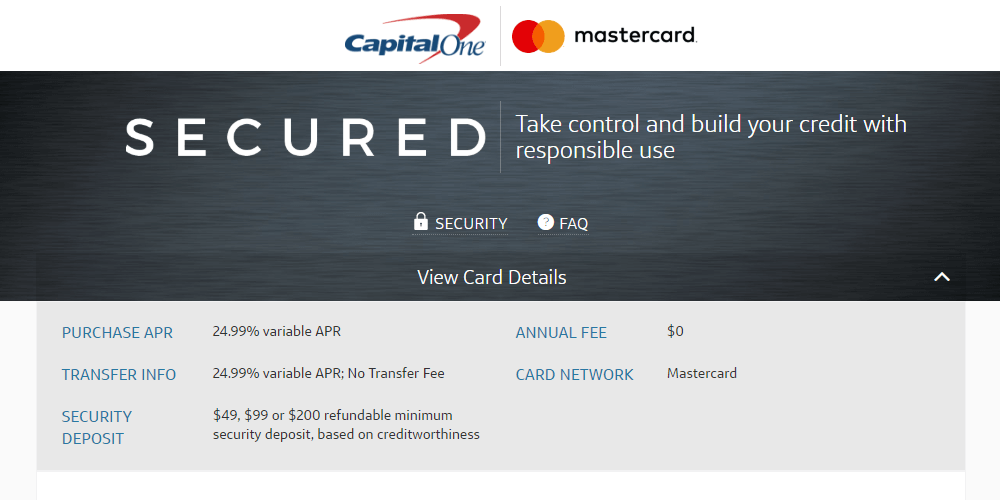

Capital One® Secured Mastercard® is a good option if you want to increase your credit score. There are no hidden fees and annual fees of $0. The current APR is 26.99% Variable APR, which is high. However, this is a good secure credit card with a small fee from a reputable company.

Over the years, Capital One has tried to serve the widest range of customers by relying on its own consumer database to supplement information from credit reporting agencies. The company's acquisition of the Orchard Bank brand and the Household Bank from HSBC strengthened its position as the main provider of state credit cards for limited credit. If the Capital One credit card approval system cannot approve you for an unsecured account, you are likely to get an offer for one of the issuer's secure cards.

Unlike ordinary safe cards, you may not need to leave a deposit for your entire credit line. Capital One has issued a secure credit card with deposits of only 30 to 50 percent of available credit. After 6 to 18 months of monthly payments on time, responsible use and your credit worthiness, Capital One can re-evaluate your credit. If you meet the requirements, your partially secured credit limit can be converted to a standard Master card on the same tariff schedule. According to posts on our credit card forums and elsewhere, some Capital One account holders are guaranteed to receive offers for secondary cards without a guarantee of several months into their relationship with the bank.

Capital One® Secured Mastercard® is a good option if you want to increase your credit score. There are no hidden fees and annual fees of $0. The current APR is 26.99% Variable APR, which is high. However, this is a good secure credit card with a small fee from a reputable company.

Capital One secured Mastercard card

Capital One® Secured Mastercard® has several other important features, including a series of low start deposit options and the ability to increase your credit limit without having to deposit more money.Over the years, Capital One has tried to serve the widest range of customers by relying on its own consumer database to supplement information from credit reporting agencies. The company's acquisition of the Orchard Bank brand and the Household Bank from HSBC strengthened its position as the main provider of state credit cards for limited credit. If the Capital One credit card approval system cannot approve you for an unsecured account, you are likely to get an offer for one of the issuer's secure cards.

Unlike ordinary safe cards, you may not need to leave a deposit for your entire credit line. Capital One has issued a secure credit card with deposits of only 30 to 50 percent of available credit. After 6 to 18 months of monthly payments on time, responsible use and your credit worthiness, Capital One can re-evaluate your credit. If you meet the requirements, your partially secured credit limit can be converted to a standard Master card on the same tariff schedule. According to posts on our credit card forums and elsewhere, some Capital One account holders are guaranteed to receive offers for secondary cards without a guarantee of several months into their relationship with the bank.

Capital One Secured Mastercard is a good choice for bad credit.

For more reference about this post, find it on Google, Bing, Yahoo.

Share this post to your friends on social media at: